Today stock pick is a chinese company listed in Nasdaq.This growing company is non other than AXT Inc. Can this chinese company can be attactive as per the chinese model above. Maybe....

Click on the above image to enlarge

As usual my analysis will begin with the chart. The chart of AXT shows that this stock has dropped from the recent high of $12 to the current level of about $7. This is a whopping 40% drop in less than 2 weeks. I believe that this stock is ready to move upward due to the short covering by the speculators and also the attractiveness of this stock at the current level.

Technically, this chart shows an oversold position as per the MACD and stochastic. The recent downward gap with huge volume also indicated that there is a big changes in the stock ownvership from the seller to the buyer. I believe all the selling on this stock has been conmpletely absorbed by the buyer and no more selling for the coming near terms.

The chart also indicate that this stock might be heading for a good rebound up to the $9 level which is the 1st resistance. If this stock can break the $9, I will do another stock analysis for this stock again.

I have recently bought a whopping 12,000 stock in AXTI due to the bullish harami pattern. Please refer to below for the explanation for bullish harami. AXTI clearly shows a bullish harami pattern and it manage to convince me to jump into this stock. And true enough, after I took my position in this stock, it end the day with a 3% gain from my average entry price of $7.23.

Conclusion:

I am very convinced that this stock will head to the $9 level for at least a 20% gain. I also believe that the recent sell down in this stock is very much overdone and also it is definetely the work of the stock operator who go short on this stock. I think that it is time for the stock operator to cover their position in this stock which inevitably will help to push this stock higher.

AXTI is a seasonal stock which the price of this stock can fluctuate greatly. Now is definetely the time to go long on this stock for the coming near future, as the overall US economy is poised for a serious rebound.

What Does Bullish Harami Mean?

A candlestick chart pattern in which a large candlestick is followed by a smaller candlestick whose body is located within the vertical range of the larger body. In terms of candlestick colors, the bullish harami is a downtrend of negative-colored (black) candlesticks engulfing a small positive (white) candlestick, giving a sign of a reversal of the downward trend.

Investopedia explains Bullish Harami

Because the bullish harami indicates that the falling trend (bearish trend) may be reversing, it signals that it's a good time to enter into a long position. The smaller the second (white) candlestick, the more likely the reversal.

AXTI has recently announced an earning per share of $0.15 which is 1 cents below the analyst estimates. I believe that the selling panic over this stock has been overdone, as I believe that the earning per share for this stock will continue to grow in the coming quarters, although the next quarter estimates will be lower than analysis estimates.

==================================================

Disclaimer : This is not an investment advisory, and should not be used to make investment decisions. Information in The Market Oracle Blog is often opinionated and should be considered for information purposes only. No stock exchange anywhere has approved or disapproved of the information contained herein. There is no express or implied solicitation to buy or sell securities. The charts provided here are not meant for investment purposes and only serve as technical examples. Don't consider buying or selling any stock without conducting your own due diligence.

==================================================

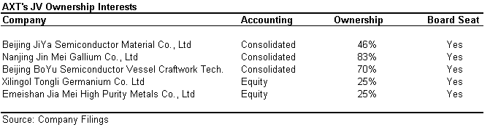

AXT and CalAmp: Two New Picks for 2011

AXT designs, develops, manufactures and distributes high-performance compound and single element semiconductor substrates comprising gallium arsenide (GaAs), indium phosphide (InP) and germanium (Ge) through its manufacturing facilities in Beijing, China. In addition, AXT maintains its sales, administration and customer service functions at its headquarters in Fremont, California. The company's substrate products are used primarily in lighting display applications, wireless communications, fiber optic communications and solar cell. Its vertical gradient freeze (VGF) technique for manufacturing semiconductor substrates provides significant benefits over other methods and enabled AXT to become a leading manufacturer of such substrates. AXT has manufacturing facilities in China and invests in five joint ventures producing raw materials.

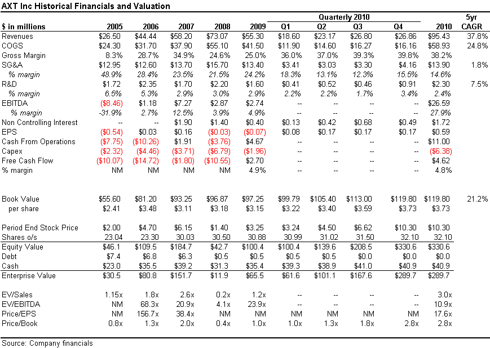

The company experienced rapid growth during the internet "boom" years from 1998 to 2000, with sales growing steadily from $49 million in 1998 to $121.5 million in 2000. Thereafter, annual sales spiraled downward and bottomed out at $26.5 million in 2005. Large losses were recorded in each year from 2002 through 2005. Thereafter, operating results improved, with sales climbing each year until peaking at $73.1 million in 2008, and then falling back down to $55.4 million 2009.

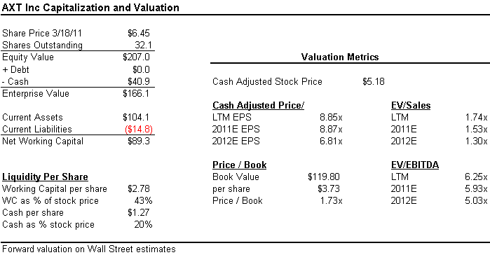

Quarterly sales bottomed out in the first quarter of 2009 (low point of the recession) at $7.7 million, and have increased sequentially in each quarter thereafter, and totaled $26.8 million by the third quarter in 2010. The company returned to profitability in the third quarter of 2009 and net income has been growing with sales. Analysts are forecasting sales of $97.5 million for 2010 and $123.9 million for 2011. Current earnings per share estimates call for $0.60 in 2010 and $0.70 in 2011, which are up from small losses in the years 2008 (-$0.03) and 2009 (-$0.06). Generally, analysts having been raising their forecasts and management has been increasing its guidance in recent quarters. The company has a solid balance sheet with cash and equivalents of $41 million, total liabilities of just $12.6 million, and shareholder equity of $113 million at September 30, 2010.

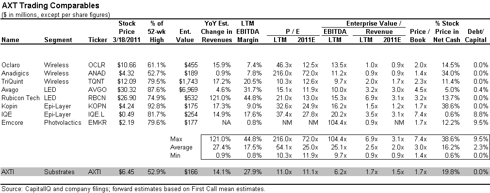

With total diluted shares outstanding of about 32.5 million shares the current market cap is around $340 million. Operating margins have improved nicely after the first quarter in 2009. See our

summary worksheet for AXT Inc. showing fundamentals and metrics for the 5 calendar years 2005-2009, and the first three quarters in 2010.

Besides a much stronger economy, the company appears to be benefiting from a number of managerial changes made in 2009: including the Board appointing Dr. Morris S. Young as the chief executive officer replacing Dr. Philip C.S. Yin, who resigned as chairman of the Board and chief executive officer on March 17, 2009. Additional executive changes were made in 2009 and continuing to date, including the termination of the Vice President of Global Sales and Marketing on December 31, 2010, “as a result of a change in the organizational structure of the company and the elimination of that position with the company”.

Recently, the stock price reached a multi year high and closed at $10.46 on January 7, 2011, which is near the high end of its 52 week range of $10.74 - $2.65. We established our long position from October 29 through November 30, 2010 at an average cost of $8.08. We would look to buy more shares if the stock pulls back to the $8.00 to $8.50 range. My target price for AXTI is currently $15 sometime in 2011, but this can be revised depending on the company’s future operating results.

A potential negative is that Bookings for Semiconductor Equipment Manufacturers, while still healthy, have been trending down in recent months (October & November 2010) from the highs reached in the months of July and August 2010, as reflected in the chart below:

January 12, 2011 – SeekingAlpha

------------------------------------------------------------------------------

AXTBy taking advantage of the

current tech boom and the resulting increased demand for its materials, semiconductor substrate producer

AXT has benefitted from rising sales and profits. It's

outpacing the efforts even of

TriQuint Semiconductor (Nasdaq: TQNT), a notable outperformer that is riding the coattails of the iPad's popularity. In its latest quarter, sales at AXT were up 60% while profits doubled as smartphones and other intelligent wireless devices drove growth, helping some CAPS members decide that this was

one hot stock.

With AXT's stock having tripled over the past year, CAPS member

LoveMeSomeGreen says investors shouldn't worry about it going higher still.

Don't fear these stocks with big gains this year! Look at AXTI from the April highs thru today. The markets have gone practically nowhere, and these guys have managed solid revenue growth in this slow growth environment. Last time I checked, that was a good thing. This stock was trading at 25 p/e until these two back to back monster quarters. This is a still a golden pony.

Adding AXT to

your watchlist allows you to stay on top of all the timely Foolish news and analysis.

Stock | CAPS Rating Sept. 7 | CAPS Rating Dec. 7 | Trailing 4-Week Performance | P/E Ratio |

|---|

| AXT (Nasdaq: AXTI) | ** | *** | 7% | 17.0 |

December 08, 2010 – The Motley Fool

----------------------------------------------------------------------------